Capital gains tax on business sale calculator

Business assets you may need to pay tax on include. Capital Gains Tax Calculation Proceeds of Disposition - Adjusted Cost Base Total Capital Gain Total Capital Gain 50 Inclusion Rate Taxable Capital Gain Taxable Capital.

Capital Gains Yield Cgy Formula Calculation Example And Guide

You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of all or part of a business asset.

. When filling out Schedule 3 you multiply that amount by 50. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds. Small business 50 active asset reduction If you own a small business you can reduce your capital gain on active business assets you have owned for 12 months or more by.

The rate of CGT that you pay each year depends on the asset youve sold and how much you earn overall. Includes short and long-term Federal and State Capital. More help with capital gains calculations.

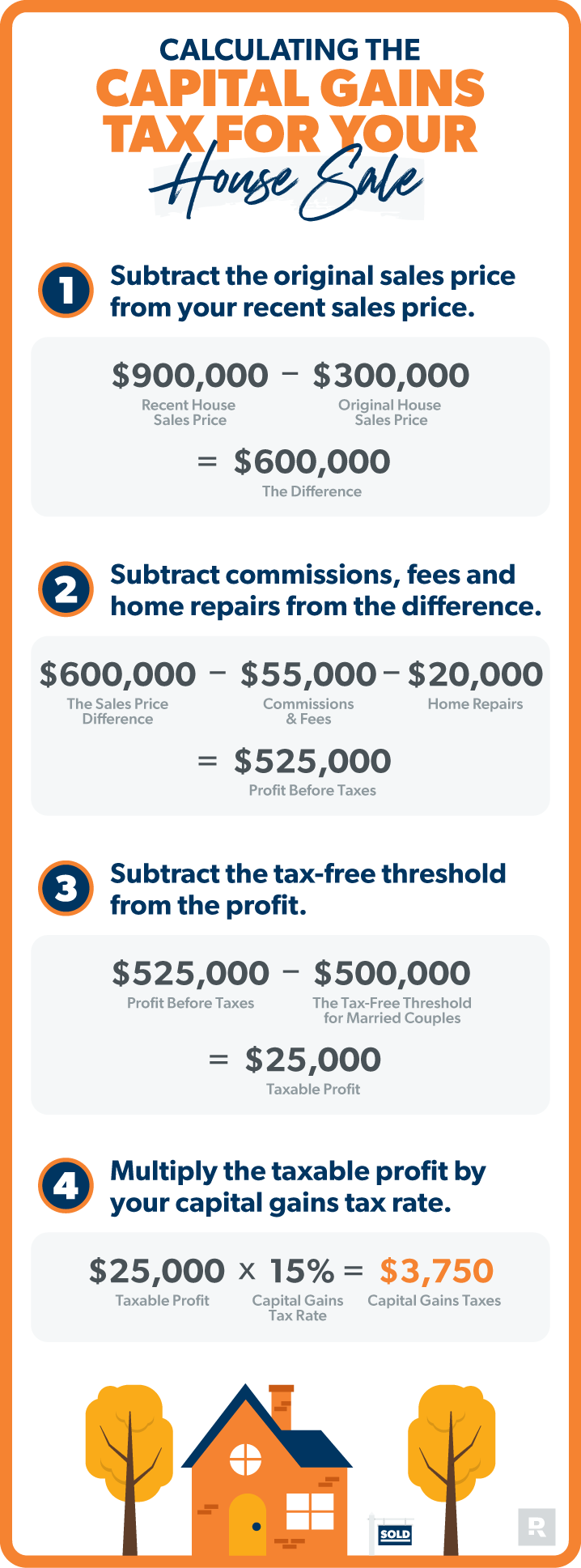

The capital gains you might owe if you sell your home vary depending on your tax filing status and the sales price of your home. Our calculator also shows how much you can potentially save when selling your. Calculate the Capital Gains Tax due on the sale of your asset.

Capital gains and losses are taxed differently from income like wages. Any gains above the 1m threshold are taxed at the full rate - 20 if youve received taxable income or capital gains above 50270 in 2022-23 the same as in 2021-22 for most parts of. Year in and year out as a business owner you pay taxes on whats called ordinary income.

Our capital gain calculator helps you compute the tax payable while you only need to enter the basic details. Heres how that works. You may also be eligible for an exclusion.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Example Purchase Price of Stocks 10000 Selling Price of Stock 12000. 2022 Capital Gains Tax Calculator.

An online calculator that is easy to use helps you determine the capital gain. Use our Capital Gains Tax calculator to work out what tax you owe on your investment. The amount of capital gains that are owed depends on your income filing status and length of ownership.

You report 350000 in capital gains related to the sale of your farming business. The IRS might allow. Use this tool to estimate capital gains taxes you may owe after selling an investment property.

This handy calculator helps you avoid tedious number. The current long-term capital gains tax rates are 0 15 and 20 depending on income. When you sell your business the tax on the increased value of your business is called capital gains.

Calculate the Capital Gains Tax due on the sale of your asset. FAQ Blog Calculators Students Logbook Contact LOGIN. Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28.

Our calculator can help you understand how much you would owe to the IRS in capital gains taxes. The long-term capital gains tax rate applies to assets held for longer than one year.

Capital Gain Tax Calculator 2022 2021

2022 Capital Gains Tax Rates By State Smartasset

Calculating Capital Gains Tax On The Sale Of A Collectible

Capital Gains Tax Calculator The Turbotax Blog

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital Gains Tax What Is It When Do You Pay It

Page Not Found Investopedia Tax Time Filing Taxes Tax Return

What Are The Different Types Of Taxes Smartasset Types Of Taxes Capital Gains Tax Tax

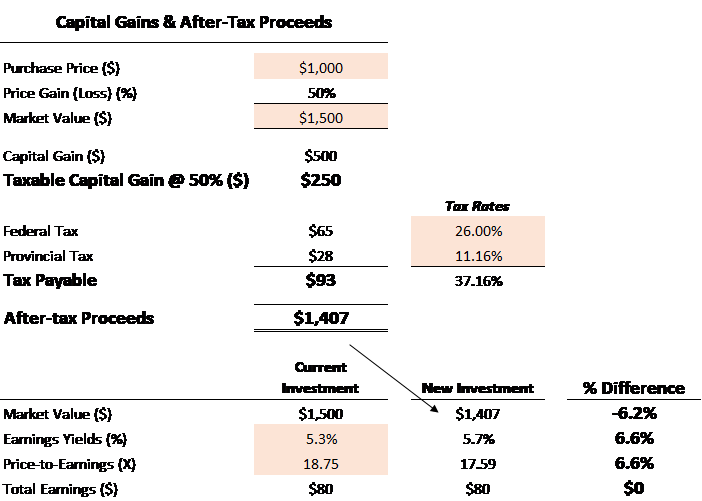

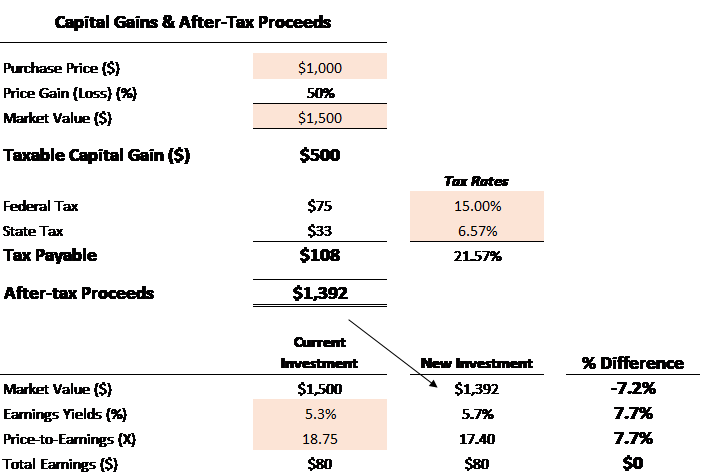

Capital Gains Tax Calculator For Relative Value Investing

Agency Vs Freelancers Vs In House Content Marketing Capital Gains Tax Accounting And Finance How To Get Rich

Capital Gains Tax Calculator 2022 Casaplorer

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Capital Gains Tax Calculator For Relative Value Investing