Compound interest calculator with withdrawals

The majority of Australian savings accounts that provide compound interest allow you to make withdrawals and additional deposits whenever you need to. Compound interest is the power of interest over timeinterest accrues and adds to the next interest payment.

Yearly Savings Calculator Compound Interest Calculator With Regular Annual Deposits

We start with A which is your investment horizon or goal.

. This savings calculator includes. Compound interest is a powerful force for people who want to build their savings. Letting your money grow or regularly.

This can be used in combination with regular deposits. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested earning you more interest. Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest.

Compound interest can have a dramatic effect on the growth of regular savings and lump sum deposits. As a wise man once said Money makes money. A the future value or FV of the investmentloan including interest.

Best age to take Social Security. Compound Daily Interest Calculator. In other words the results of what you can achieve through the magic of.

For example if we assume we invested 100 at a 26 rate compounded annually for 1195 days and i use this basic excel formula 1001261001195365 and result is 2131132 and if i do the same calculations in your calculator it shows 21414 please help to explain the difference. The calculator will estimate your monthly payment to help you determine how much car. If you return the cash to your IRA within 3 years you will not owe the tax payment.

P the principal investment amount the initial deposit or loan amount also known as present value or PV. Pa before tax and super max. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

R is also known as rate of return. Hello Sir i was trying to calculate compound interest for years that are in decimal. FV future value.

Most years have 365 days while leap years have 366 days. A compound interest calculator such as ours makes this calculation an easy one. While this may not seem like much once we increase the variable of the years of the 20000 compound interest investment we would see a balance of 98977 in 50 years compared to just 52500 with simple interest.

Our simple savings calculator helps you project the growth and future value of your money over time. The amount of interest a money market account pays and whether its the highest-paying deposit product offered varies from bank to bank. N the number compounding periods per year n 1 for annually n 12 for monthly etc.

How to avoid early withdrawals. You can calculate based on daily monthly or yearly compounding. Bankrates compound interest calculator can help you calculate how much.

You can include regular withdrawals within your compound interest calculation as either a monetary withdrawal or as a percentage of interestearnings. The formula for compound interest is A P1 rnnt where P is the principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods. The more frequently this occurs the sooner your accumulated.

This calculator allows you to choose the frequency that your investments interest or income is added to your account. Thought to have. Compound interest or interest on interest is calculated using the compound interest formula.

How to avoid early. Determine How Compound Interest Can Grow Your Savings What could my current savings grow to. Interest Earnings on an investments earnings plus previous interest.

This compounding interest calculator shows how compounding can boost your savings over time. How to avoid early withdrawals. Most bank savings accounts use a daily average balance to compound interest daily and then add the amount to the accounts balance monthly.

Using this compound interest calculator Try your calculations both with and without a monthly contribution say 50 to 200 depending on what you can afford. The sooner you start investing the more time you have for interest to compound on interest. 1000000 Desired retirement age.

PV present value initial deposit r annual interest rate as a decimal rather than percent also called APR n number of times interest is. The 1000 investment in the example above increased by 983 from year 5 to year 10 and by 7064 from. Use this calculator to determine the potential future value of your savings.

How to calculate your savings growth. This means there is a bit more than 52 weeks in the average year with there being 52 weeks and 1 day in most years while there is 52 weeks and 2. Simply enter the amount you wish to borrow the length of your intended loan vehicle type and interest rate.

It uses the compound interest formula giving options for daily weekly monthly quarterly half yearly and yearly compoundingIf you want to know the compound interval for your savings account or investment you should be able to find out by. How to avoid early. FV PV 1 rn nt.

Best age to take Social Security. Best and worst states for retirement. 25 If you are self employed enter in 0 for employer contribution and enter all your contributions as voluntary.

401K and other retirement plans. With simple interest the balance on that bond would have been 23250 on the maturity date. Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

Traditional IRA calculator. 75 This calculator is limited to a retirement age of 75Income. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Best and worst states for retirement. R the annual interest rate expressed in decimal form decimal 100.

Here are the best money market account rates. Withdrawals and deposits can also affect your account balance. Learn how to calculate compound interest.

The above calculator automatically does this for you but if you wanted to calculate compound interest manually the formula is.

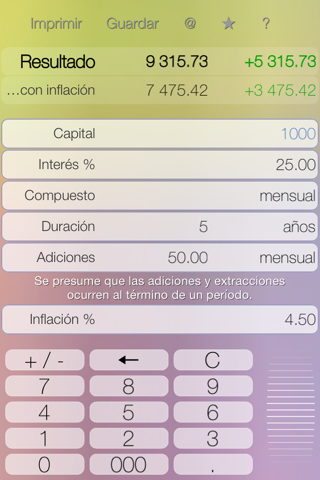

Descargar Mejor Aplicacion Deposit Compound Interest Calculator With Periodic Additions And Withdrawals

Yearly Savings Calculator Compound Interest Calculator With Regular Annual Deposits

Payout Annuities Mathematics For The Liberal Arts Corequisite

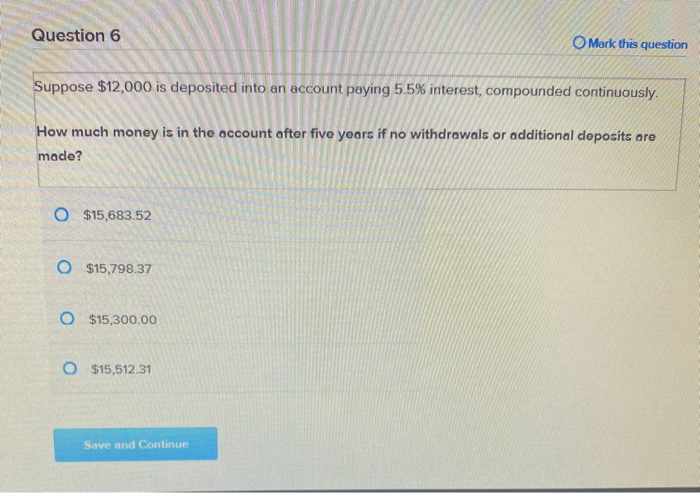

Solved Question 6 O Mark This Question Suppose 12 000 Is Chegg Com

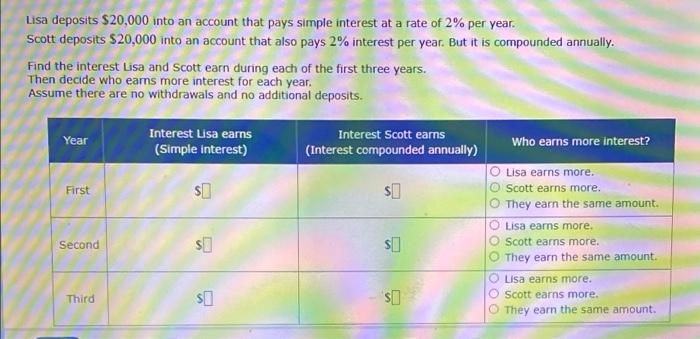

Solved Lisa Deposits 20 000 Into An Account That Pays Chegg Com

Yearly Savings Calculator Compound Interest Calculator With Regular Annual Deposits

Payout Annuities Mathematics For The Liberal Arts Corequisite

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite

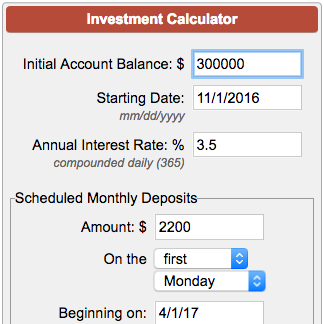

Investment Account Calculator

Investment Calculator With Withdrawals Discount 52 Off Sportsregras Com

Openalgebra Com Interest Problems

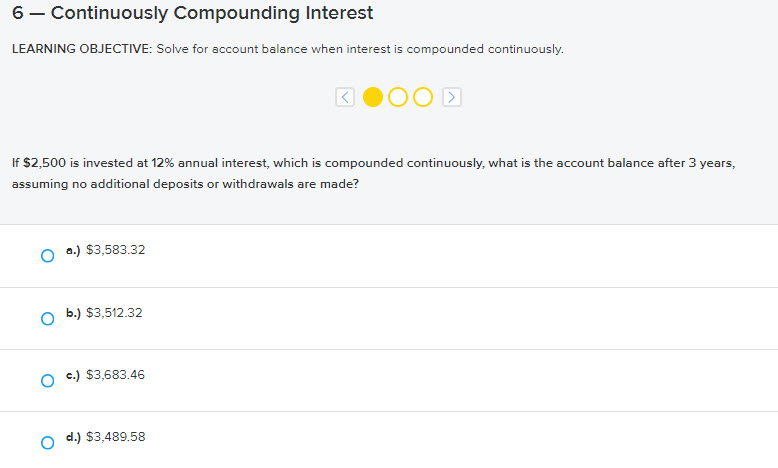

Solved 6 Continuously Compounding Interest Learning Chegg Com

Yearly Savings Calculator Compound Interest Calculator With Regular Annual Deposits

Investment Calculator With Withdrawals Discount 52 Off Sportsregras Com

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite

Investment Calculator With Withdrawals Discount 52 Off Sportsregras Com

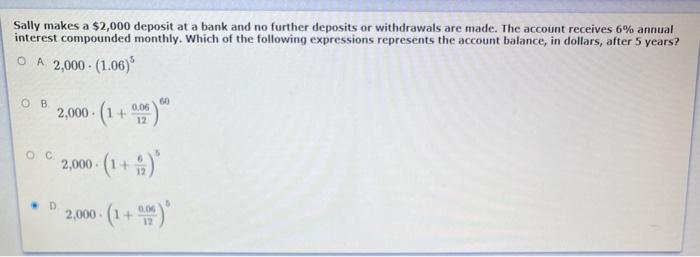

Solved Sally Makes A 2 000 Deposit At A Bank And No Further Chegg Com